23 November, 2016 | Water

Victoria will be implementing a new water pricing framework for the next regulatory price review in 2018. The framework will apply to 16 of the State’s urban water businesses and Southern Rural Water [1].

In May 2016, the Essential Services Commission (ESC) released a position paper setting out its proposed new pricing approach, and invited submissions on its proposal[2]. Based on feedback received through this consultation process, the ESC released a final report in October that sets out the water pricing framework and approach that is to be implemented from 2018.[3]

The ESC notes that submissions were generally supportive of the overall proposal, in particular the focus on customer value and the incentives to prepare high quality price submissions. Accordingly, the water pricing framework set out in the October report is consistent with implementing the approach proposed in the May position paper.

This briefing note summarises the impetus for the new framework, its key features and draws attention to elements that have been modified, refined or firmed up since the ESC’s May position paper.

Victorian water businesses have been regulated under a ‘building block’ method since 2004. In the decade or so since the first regulatory review, this method has yielded tangible gains in the form of reduced costs and improved service to customers. There is also a much better system of performance reporting and greater transparency around how prices relate to costs.

Despite these gains, it has become apparent that more can and should be done to promote efficiency in the sector and better outcomes for customers. The ESC’s position paper identified a number of limitations of the current regulatory framework, which we summarise as follows:

These weaknesses have been the impetus for the ESC’s search for a new and better approach that builds on the efficiency gains achieved thus far. The ESC sought to develop a regulatory approach that would deliver greater customer focus, more effective incentives to lift performance (both financial and non-financial), greater business autonomy, meaningful performance outcomes and regulatory simplicity.

The new model has several key features that are crafted to work together to achieve ESC’s stated objectives. The framework capitalises on the fact that there is a relatively large number of water businesses in Victoria, which provides some scope for competitive tension and comparative performance through rankings.

A central feature of the new approach is to reward those businesses that are assessed to have an “ambitious” pricing submission in terms of giving customers value for money for what they want and well presented (from the regulator’s perspective in terms of the content and rigour of the submission). The reward will be in the form of a higher allowable rate of return (as opposed to the current regulatory approach in which a standard cost of equity is applied across all businesses).

It is also expected that businesses will attain reputational benefits from producing a high quality submission, and this will further incentivise efficiency improvement.

The design features of the new framework are as follows:

Five criteria form the basis of the assessment framework, referred to as “PREMO”. PREMO is an acronym for the parameters of an assessment; an ambitious submission is one that rates highly against each of the five criteria, that is:

Each water business, in consultation with its customers, will determine the level of ambition to be adopted in its price submission. Businesses will be required to self-assess their level of ambition (and corresponding cost of equity) against the PREMO assessment criteria. After receiving the price submission, ESC will also rate it against the PREMO elements.

Using the PREMO assessment framework, price submissions will be rated by businesses and ESC as belonging to one of three categories: Leading, Advanced, Standard of Basic.

The allowed rate of return on equity will increase progressively with movement up the scale from Basic to Leading. As an indicative guide, the ESC has advised that the allowable cost of equity for a ‘leading’ submission will be around 1.2% above that of a ‘basic’ price submission (assessed in conventional regulatory terms). The allowable cost of equity for a ‘basic’ submission will be below conventional regulatory benchmarks.[4]

This represents a significant departure from the previous regulatory framework in which a single weighted average cost of capital (WACC) was applied uniformly to every water business. Water businesses will continue to recover a benchmark cost of debt, but estimated using a ‘trailing average’ approach rather than the previous ‘on-the-day’ approach.

ESC advises that the allowed return on equity for a Standard price submission would be largely unchanged from the one expected under the current framework, given that this level represents a continuation of current outcomes and targets for cost efficiency.

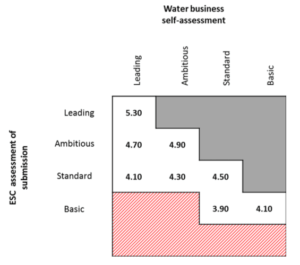

Financial disincentives apply for businesses that overstate their level of ambition. An “incentive matrix” has been formulated (see Figure 1), which assigns businesses a return on equity that is lower than what it would have received had it accurately assessed its rating.

PREMO Incentive Matrix – Indicative regulated return on equity (real)

This is effectively a penalty for businesses that seek to game the framework by claiming a level of ambition that they know to be untrue. Not only do they run the risk of their submission being downgraded, they also forego potentially higher rate of return that could have been attained had the business honestly assessed its submission). There is a ‘red zone’ for very poorly developed submissions for which the consequences are unspecified at this time.

The framework allows the cost of equity established at the start of a pricing period to be adjusted depending on how well a business performs against the outcome commitments in its price submission (however ESC indicates that in-period adjustments should be the exception rather than the rule).

High quality submissions will be fast tracked through the assessment process to an early draft and final decision, potentially saving businesses costs and time – thus representing an added incentive to prepare a high quality submission.

The ESC does not intend to provide a check-list set of criteria for a business to qualify for fast tracking. Instead, it considers that a price submission can be fast tracked to an early draft decision if it is satisfied with the proposals in the price submission, and considers that no further enquiry is required because of the “significant, transparent and credible evidence put forward in the submission”.

ESC has advised that it will provide further guidance to water businesses prior to price reviews, as required under the Water Industry Regulatory Order. This will supplement the framework that has been outlined in the ESC’s October report.

The new framework requires businesses, as a first step, to engage with its customers and community to inform the outcomes to be delivered in a pricing period.

The ESC is not intending to prescribe the manner in which water businesses engage with their customers. It takes the view that each water business is best positioned to explore different approaches to find the engagement strategy that works best for its customers.

However, ESC has developed five principles for good customer engagement, which will form the basis of its assessment of price submissions.

The new framework is to be ‘outcomes focussed’, which represents a key shift in emphasis from the previous framework (which has typically focussed on the cost of inputs). A business will be required to describe what its customers will receive for the prices charged, and how this relates to customers’ expectations as revealed through the engagement. A business will also be expected to report its performance against the proposed customer outcomes, to clearly demonstrate whether it has delivered the customer value it promised for the prices charged.

According to ESC, the proposed customer outcomes will effectively replace the previous core ‘service standards’ encapsulated in the ESC’s Customer Service Code (although ESC has committed to retaining the service standards as they do serve as a comparative measure of performance for specific metrics for each business from year-to-year, and also across businesses each year, so form an important part of ESC’s comparative performance reporting program).

ESC stipulates that the outcomes should be:

In addition to defining outcomes that reflect customer expectations and preferences, a price submission will need to contain/demonstrate:

The framework requires businesses to clearly indicate the form of price control for each service, accompanied by an explanation of how the proposed form of control meets the WIRO requirements. The form of price control can include processes for approving individual prices, pricing principles, and explicit price controls (such as a price cap, revenue cap, or hybrid approach). The business must demonstrate that any change in price control has been undertaken in consultation with customers and takes into account risk management, price stability, transition arrangements, and customer choice.

ESC intends to continue its previous approach of allowing businesses a large degree of discretion to decide on tariff structures. Under the new framework, businesses will be required to justify any proposed change in prices or tariffs with reference to appropriate customer engagement and support.

While the new pricing approach retains many of the elements of the current model (notably the retention of the building blocks methodology), there will be a substantial learning phase over which businesses will need to understand the new assessment criteria and how to prepare their pricing submission to meet the requirements of the new model.

The ESC has undertaken to provide more guidance ahead of the 2018 price review and this guidance will be crucial to water businesses successfully navigating the new environment. The PREMO criteria focus on matters that are within a business’s control but each business will need to consider how the criteria apply to their own business, where they likely rate along the “ambition scale”, what would be involved in lifting performance to the next level, and whether the incentives proposed by the ESC are sufficient to warrant the cost of attaining the uplift.

For some businesses, the new model will require a significant change in the way businesses engage with their customers. The model emphasises the need to make engagement the first step in developing a price submission, not a last step. This will challenge existing norms and require a deliberate cultural change within some organisations. There is a significant and deliberate attempt to shift away from formalised customer panels and representatives to place the focus on the business engaging with its customers – a development we applaud.

The shift to an outcomes-based framework for measuring and reporting outcomes may also prove challenging for some. The aim will be to develop measures that give an overall view on business performance (i.e. how well it is meeting its strategy) as opposed to granular, engineering-based measures.

While the new approach may be confronting to some water businesses, it has several laudable attributes that will reduce businesses’ incentives to game the process and will focus their attention on customers and outcomes. These initiatives will substantially enhance the accountability of businesses and boards in the regulatory process. It is the first time a regulator has offered regulated businesses a genuine opportunity to outperform its peers, another welcome innovation.

[1] Prices for Goulburn-Murray Water (G-MW) and Melbourne Water will be established for a four and five year period respectively, from 1 July 2016. The ESC regulates the prices of G-MW under the ACCC Water Charge (Infrastructure) Rules.

[2] A New Model For Pricing Services In Victoria’s Water Sector Position Paper, May 2016

[3] Water Pricing Framework And Approach – Implementing PREMO from 2018, October 2016

[4] The cost of equity benchmark for the 2013 price review was 4.5%, which coincides with the level proposed for a standard price submission.

23 November, 2016 | Water